ESG-related challenges for individual companies tend to create chatter, buzz and sentiment changes long before information surfaces via mainstream media, adjusted ESG ratings or research reports. But traditional indicators for sentiment shifts connected to ESG-related asset issues are slow, fragmented and hard to compare and monitor. They are not on the pulse of the sentiment in the market. Being able to read, interpret and monitor all news, tweets and blogs that indicate ESG-related issues gives both investors and issuers an edge in the market.

Request your access Get a demo

ESG SENTIMENT REVIEW

Key objectives of analysing sentiment

Receive alerts about sudden changes in sentiment.

Stay ahead of mainstream sources in tracking latest ESG developments.

Investigate in depth when unusual events require further attention.

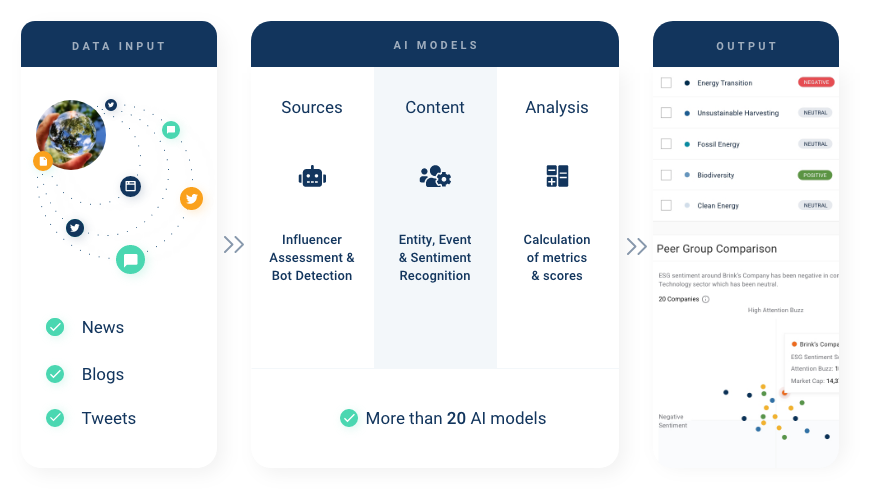

The AI-based ESG Sentiment Review surfaces ESG events reported and discussed across tweets, news and blogs by over 15 million influencers, evaluates the ESG sentiment from these events via a Score and thereby provides early views on the overall ESG sentiment and materiality of ESG events for individual companies.

Early warning functionality

Sentiment for every single company is tracked and updated daily, allowing for continuous monitoring and comparison

Drill down functionality, allowing for tracking down individual articles and tweets that have impacted ESG sentiment

Coverage of > 50,000 listed companies worldwide

Available on ScopeOne as on-platform and API

PRODUCT FEATURES

ESG Sentiment Review

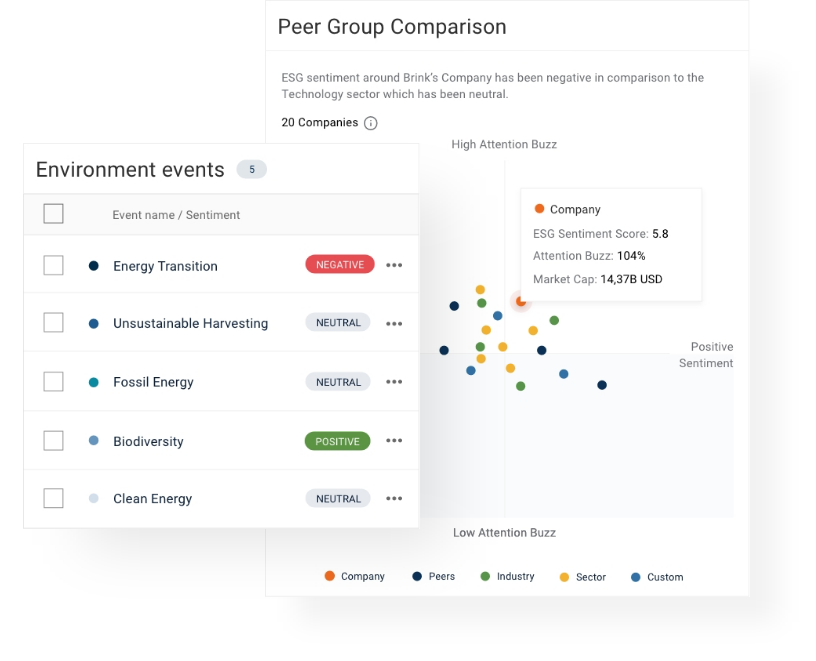

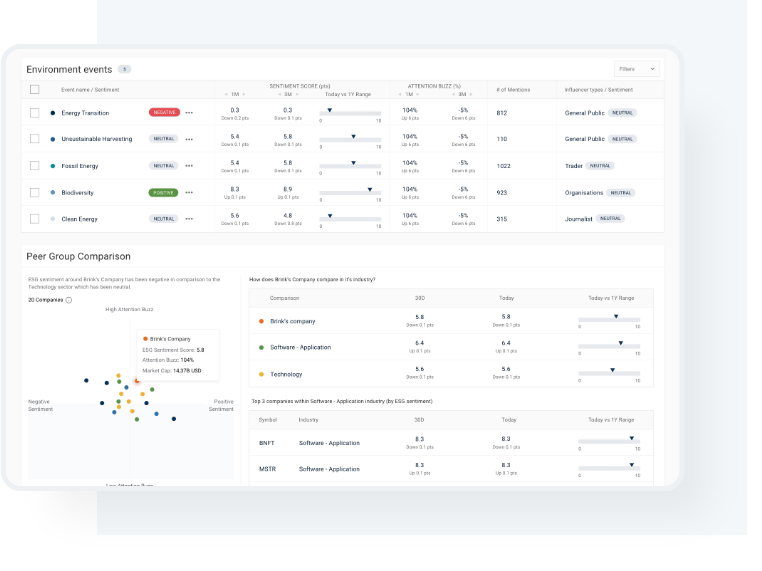

ESG Sentiment Review is connected to peer groups, making it easy to assess the significance of companies’ sentiment shifts. You will be notified if unusual and therefore potentially significant sentiment shifts are detected with regards to the companies you are tracking, as the peer groups’ standard deviation bands are utilized as references.

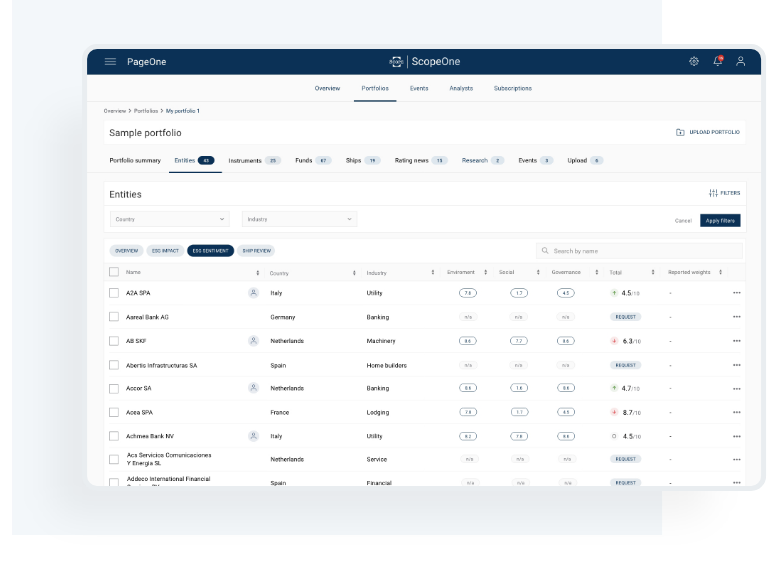

ESG Sentiment Review is embedded in ScopeOne’s Portfolio Manager, ensuring a clear overview on the portfolio of companies you are monitoring.

Drill down into each individual company you’d like to track. The Company View can be used as broad or as detailed as required. Scores give the result of the tracked data quickly and easily, and the user can drill down as far as to individual tweets that have contributed to the resulting score.

ESG SENTIMENT REVIEW

ESG Sentiment Review is powered by Sentifi in partnership with Scope.

Sentifi developed more than 25 highly sophisticated AI and deep machine learning models in investment analytics by applying social media content (e.g. Twitter, news and blogs) besides fundamental data. Sentifi is the largest licensed ingestor of social media, news and blogs globally. Sentifi’s uniqueness is clearly defined by the substantial number of models to structure ‘unstructured datasets’ and the ability to effectively combine structured and unstructured datasets (more than 200 million sources and 15 million relevant and periodically ranked influencers).

The AI-based ESG Sentiment Review surfaces ESG events reported and discussed across tweets, news and blogs by over 15 million influencers, evaluates the ESG sentiment from these events via a Score and thereby provides early views on the overall ESG sentiment and materiality of ESG events for individual companies.

Influencer Identification

New sources are automatically identified and sent through the classification and scoring workflow.

Influencer Classification

A deep learning model that classifies profiles into different categories such as traders, journalists or activists.

Influencer Scoring

A score between 1–100 measuring the influence of a source when mentoring a specific topic.

Bot Detection

A deep learning model that distinguishes human from bots.

Location detection

A ML model to determine which country a profile is coming from.